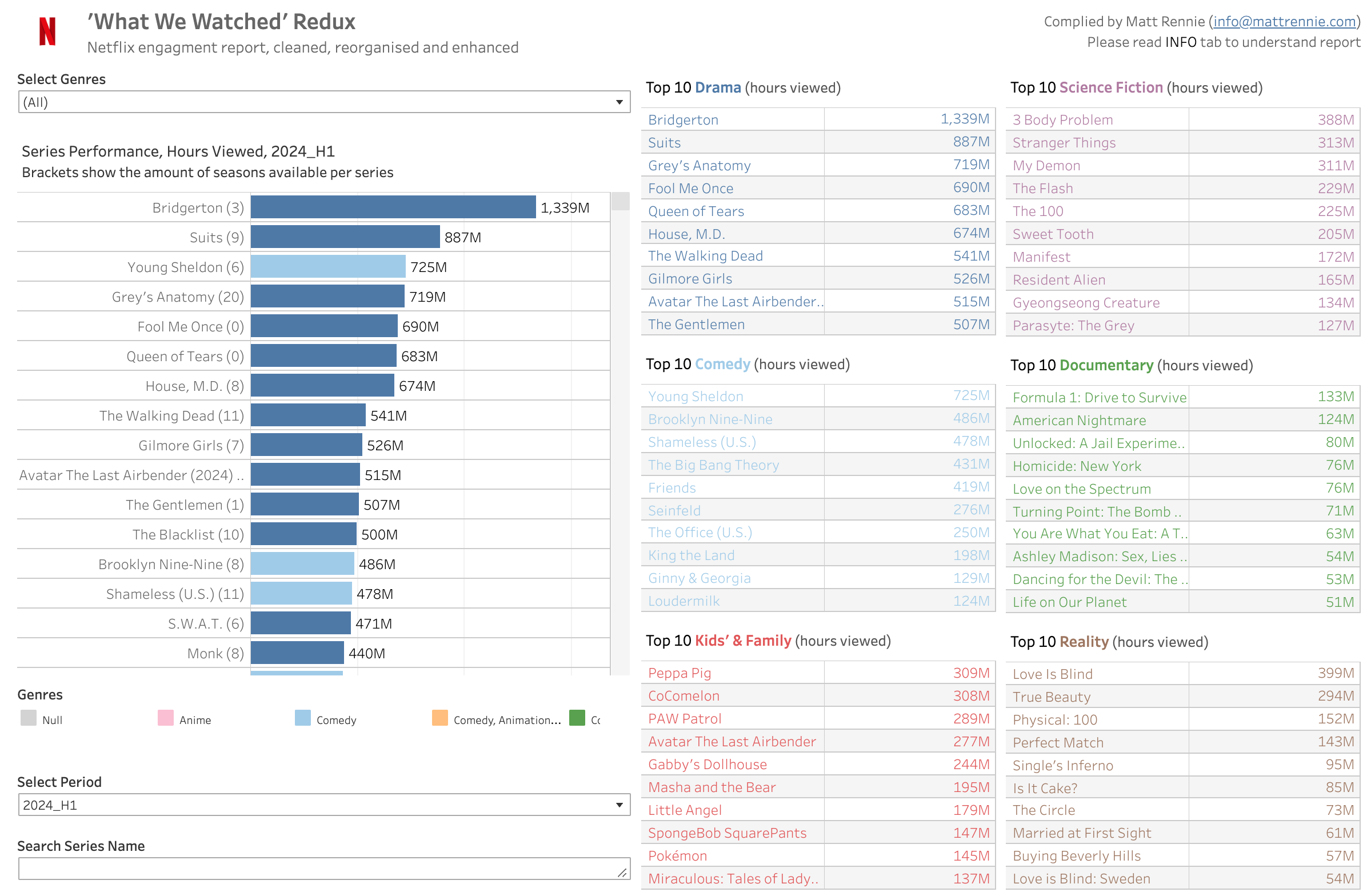

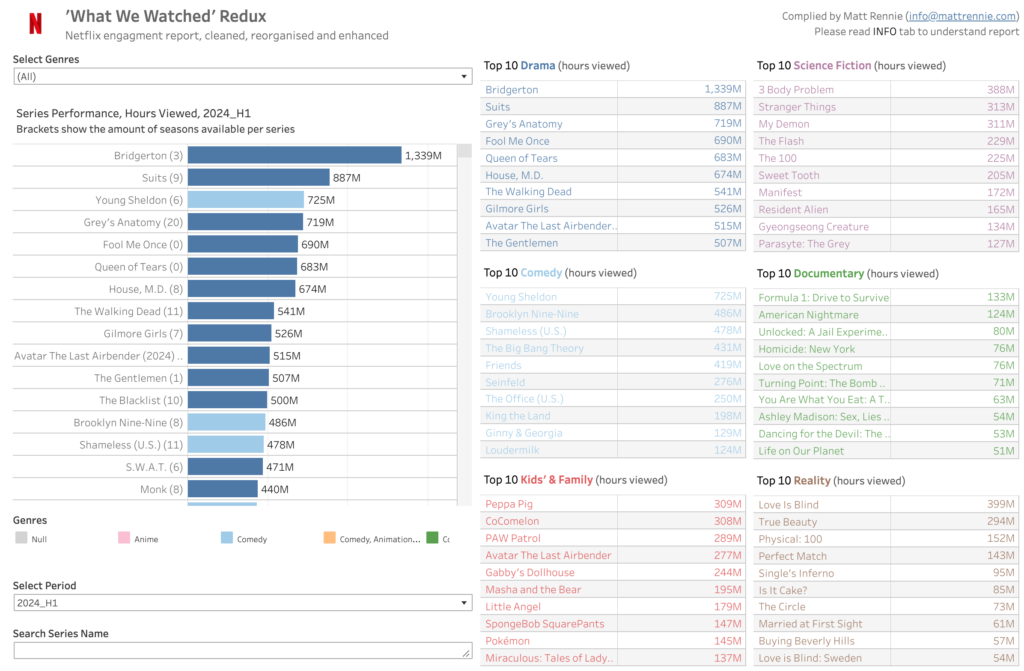

In an effort to boost transparency, Netflix have been releasing their bi-annual ‘What We Watched’ reports, which is lovely. The problem is their data is presented in a rather unwieldy 7000 line excel sheet it’s pretty hard to navigate. So I thought I’d help out…

You can access my enhanced report here: www.mattrennie.com/netflix

With a bit of spare time free last week, I compiled the 3 reports currently available (1, 2, 3) and then added some custom processing to enhance them. I ran a cleaning script to aggregate data up to Series level (rather than Season), and then aligned Series up to the open source TheTVDB.com database, leveraging a Python script to start to pull and match data from their API to embellish the data with additional info such as genres.

I have focused on Hours Viewed as the key metric, largely dropping their Views data with it’s unconventional calculation — dividing the Hours Viewed by the total Runtime of the content in question. Many platforms have their own interpretation of views (min 2″ viewed / 30″ viewed etc..) but this is a new one on me! The result only restates the Hours Viewed as a function of Runtime and isn’t much use in understanding consumer behaviour on the platform. Interestingly, it also tends to downplay the importance of large catalog series to the platform which you can see comparing the Series Performance tab to the Season Performance tab.

For now, I focused on TV Series, as they account for around 70% of all viewing. I also haven’t yet finished cleaning all of the Series data but the biggest ones that cover over 80% of all TV viewing are covered. I’ll continue working through the rest of the Series and Movies over the coming weeks.

It’s also worth noting that whilst most of the cleaning has been automated, some manual work was still necessary. I relied on TheTVDB.com, which is open source and may contain some inaccuracies. IMDB was an alternative but it’s terribly expensive. If you spot any errors or have suggestions for additional views or insights, feel free to drop me an email (info@mattrennie.com). Now I’ve laid the groundwork, updates will be relatively easy for new views or incorporating data such as from their next bi-annual report.

Oh, and Netflix… you’re welcome 😉